Donating products, services and time instead of cash is paramount to many local organizations.

| 2018 Q3 | story by Dr. Mike Anderson

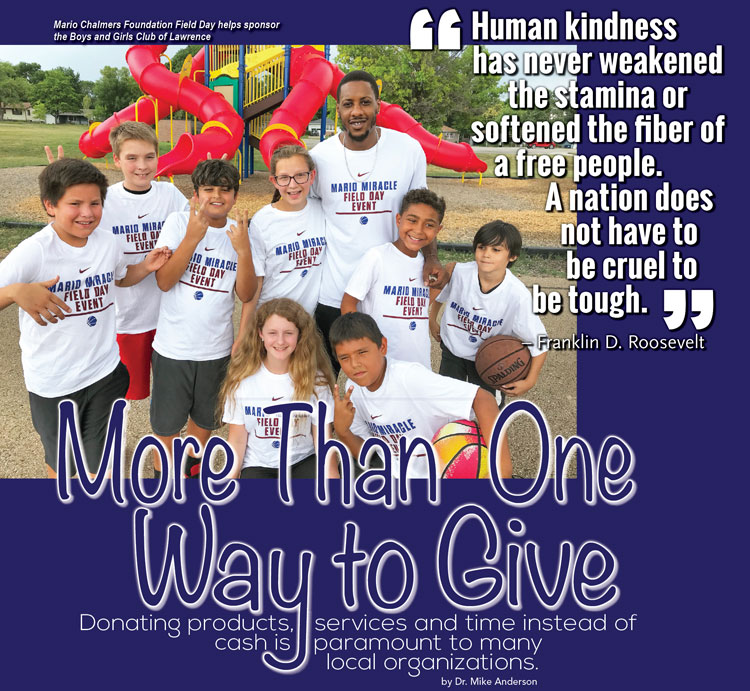

Mario Chalmers Foundation Field Day helps sponsor with Boys and Girls Club of Lawrence

In-kind donations not only play a major role in fund-raising events for not-for-profit organizations but, also, their day-to-day operations. In-kind donations are more tangible, specific and, often, the most economical way to give. They also represent the fastest-growing segment of philanthropic giving.

In-kind donations are mostly given in the form of goods or services, but they can also encompass donations of properties, stocks, bonds or other financial assets. Boys and Girls Club of Lawrence CEO Colby Wilson explains: “In-kind donations don’t get the credit that they deserve. Cash donations are always valuable, of course, but when someone gives you a donation or lowers the cost on an item or a service that they specialize in, that’s huge for us. From building the Center for Great Futures to helping our Club kids get school supplies to hosting community fund-raising events, we simply couldn’t make ends meet without in-kind donations.”

The United States is the largest in-kind donor country in the world. According to a study done at the Georgia Institute of Technology, U.S. donors (individuals, businesses and the government) contribute roughly $58 billion in in-kind donations per year. Corporations are not leading the way; Individuals and community groups contribute the largest share of in-kind donations. And, it’s not hard to see why.

Several Lawrence first responders, from the LKPD and the DGSO, volunteered on the ropes crew at the Boys and Girls Club over the edge event.

As Linda Cottin, Cottin’s Hardware and Rental, puts it: “In-kind donations allow small businesses like us to give back to the community in a broad and responsive way. Anyone who has worked in or run a business, or even managed a household budget of any kind, knows that keeping enough cash on hand to cover expenses is a tricky venture. When businesses make in-kind donations, they do not need to wait for checks to clear or business to pick up. In-kind donations allow us to donate immediately on an as-needed basis to anyone and everyone. Giving discounts, donating services, partnering with events or organizations, and donating merchandise all provide the greatest benefit to our community while reaching the largest amount of people possible. Nothing makes us happier than being able to truly help the community that we live, work and play in.”

A comprehensive study done in 2013 by the Michigan State University Center for Community and Economic Development found that 91% of local business owners across the U.S. contribute to their communities, including schools, nonprofits and community groups, by volunteering and making donations. Local business owners invest in the community and have a vested interest in the future of that community. In two further comprehensive studies conducted in 2013 in Austin, Texas, and Portland, Maine, researchers found that locally owned businesses donated four times the amount of money than corporate businesses. The relationship between locally owned businesses in Douglas County and the community is paramount.

Emily Peterson, proprietor of Merchants Pub and Plate, believes in-kind donations are a great asset to both community organizations and business owners. “With in-kind donations such as dinners, gift cards and merchandise, we are able to amplify our support, making more frequent and more significant contributions than what we would otherwise be able to accomplish with monetary donations,” she explains. “We also find this format of donations to be symbiotic: The in-kind contributions benefit the nonprofit organization, often as a fund-raising tool, and also benefit the local business by increasing its exposure, not to mention strengthening the overall fabric of our community through working together. Win-Win-Win.”

Simon and Codi Bates, Bon Bon and Burger Stand, also see in-kind donations as a great collaboration with causes about which they care. “In addition to monetary donations, in-kind donations allow us to give items, food or services that can benefit not only the organization’s bottom line but help businesses like ours show a partnership with organizations we are passionate about in the community,” Simon Bates says.

Al Hack board member at Boys and Girls Club volunteers at the Field Day Event

The difference Douglas County business owners are making with in-kind donations is highly visible. As Just Food Executive Director Elizabeth Keever puts it, “From the office furniture we work on to the computers we use and the 800,000 pounds of food donated every year, Just Food wouldn’t be able to serve thousands of Douglas County residents if it weren’t for in-kind donations.”

Before donating, however, it’s important to understand the needs of the organization to which you are donating. “People who make in-kind donations thoughtfully can really help out an organization in need, and The Willow couldn’t survive without them,” says Will Averill, the Willow Domestic Violence Center. “That being said, all nonprofits have stories of getting boxes full of things that are opened, broken, expired or in sizes and quantities they can’t handle. So, I think it’s important for people to look at why they’re donating and research the organizations they are giving the support. That way, the donation goes further, and the donor has a stronger connection to the agency they have supported. Most agencies’ donation policies are carefully thought out, and taking the time to check them out really maximizes a donor’s impact.”

It’s also important for business owners to understand what they can and can’t do with their financial deductions. Michele Hammann, a CPA with Summers, Spencer and Company P.A., wants to remind businesses that when they donate in-kind donations to a 501(c)(3), they are only allowed to deduct the actual cost of the donation and not the current fair market value. It’s also important to understand that one must classify that as a charitable contribution in financial statements. “Contributions can be limited as it relates to how much you can actually deduct in any one year, and the IRS requires that amount to be separated from your regular operating expenses,” she explains. It is also important to understand that the donation of time and the act of donating time is typically not eligible for a charitable deduction. Even if hours are billable and specialized, similar to an attorney, one does not get to deduct the contribution of time on a personal return, but the charity may be able to record it as an in-kind contribution, she continues.

Considering the number of not-for-profit organizations in Lawrence and all the organizations that strive to help adults and children, it’s vital for businesses to do what they can to help. Everyday, businesses in Lawrence are asked about in-kind or monetary donations. Some business have multiple requests for donations in one day. Cash is hard for small businesses. In-kind donations are a way to benefit both the business and the not-for-profit organization, as well as lift up and aid in the exposure of both organizations. As Matt Llewellyn, 23rd Street Brewery, says, “In-kind donations really benefit everyone. Good for the nonprofit because it helps them raise money, the business because they are not out cash but gives them exposure. Good for the public because it is a benefit to the community as a whole.”

Here in Lawrence, you don’t have to travel far to find a business that understands the importance of giving and an organization that is grateful for its gift.