When it comes to educating children about finances, there are many avenues available in Lawrence for both parents and kids.

| 2019 Q1 | story by Tara Trenary | photos by Steven Hertzog

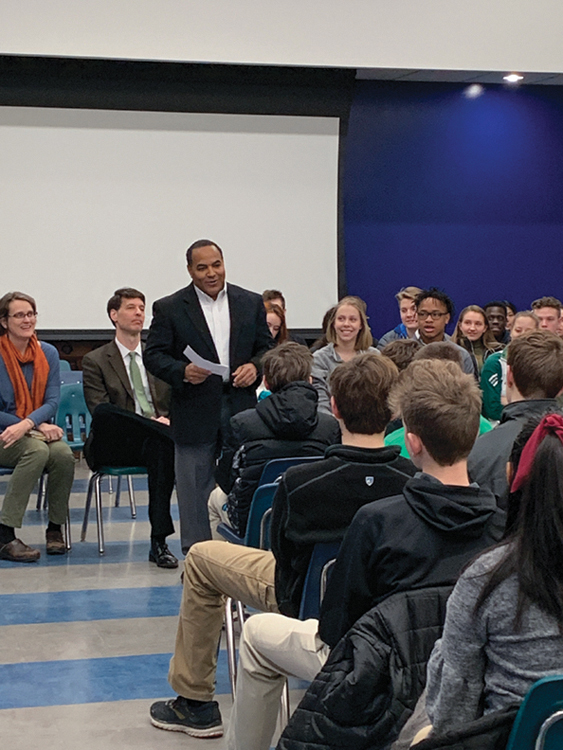

Dennis Spratt of Junior Achievement holds a class on financial literacy at Southwest Middle School

It can be a hard conversation, one many parents may hope to avoid. But if you wait too long to have “the talk” with your kids, one day it might be too late. No, I’m not talking about the birds and the bees, though that conversation is an important one. Parents talking to their kids about finances and money early and consistently might well be just as important to their futures.

The 2017 Forbes article “How To Teach Your Children About Finances … At Any Age,” by Liz Frazier Peck, explains that from college through retirement, every step kids take will be directly influenced by their ability to manage their finances. “So it’s up to the parents to make sure our children have a financial education before going out to the real world, where they will make financial decisions that will affect the rest of their lives,” Peck writes. “The more you integrate finances and money into their everyday life, the more comfortable they will be with personal finance as adults.”

Ernesto Hodison, vice president of commercial lending at Capitol Federal Savings, who works with middle- and high-school kids through the school district, says having a plan is always the most successful way to make the most of your money.

“There is a lot that goes into educating young people to acquire a skill or trade to earn money, but they then must understand how to effectively manage what they earn,” he explains. “Teaching them the relationships of earning to spending to saving is important.”

So when it comes to teaching financial fitness to kids, what’s the best approach?

Hodison explains that each individual is different and has different goals, but there are certain universal understandings that are needed to make solid financial decisions: knowing what gross and net pay are, wants versus needs and debt and credit.

But the most important thing kids need to learn, Hodison says, is how to budget. “A budget will keep them on track. A lot of upper-class high-schoolers and college students have jobs, so there is an increased urgency to understand about how to handle their finances. They will need to become self-sufficient in handling their finances and create stability for their financial future.”

He says students at the high-school and college stages are preparing for a career and will need to expand their horizons and add in education on life expenses like insurance, retirement and investment.

So teaching about finances early on in a child’s life can be crucial.

LEADING THE WAY

Though parents are usually the primary educators and models for their kids, there are many other ways kids can learn about finances within the community. School is one of the most important of those.

Jennifer Bessolo, Ed.D., Lawrence Public Schools curriculum director, explains that the district offers financial literacy curriculum at all grade levels: elementary, middle and high school. “There’s an authentic nature to the work as it’s woven into many of our course curriculums, in addition to stand-alone courses in financial literacy.”

She says the district offers a variety of course offerings at all levels, units, partnerships with community businesses and guest speakers, including United Way’s Reality U as well as other local businesses that are part of the Lawrence Schools Foundation LEAP (Lawrence Education Achievement Partners) program. Through the Career and Technical Education Pathway, the district also offers Business, Finance and Marketing Pathway courses for high school students.

One of the biggest partners of the Lawrence School District in regards to financial education in its schools is Junior Achievement.

Dennis M. Spratt, Wealth Management Group of Kansas City Inc. and Junior Achievement (JA) Advisory Board member for Lawrence, has taught the eighth-grade Junior Achievement program for the past seven years, guiding students in career exploration, the importance of developing a personal and family budget, using credit cards wisely and the importance of a credit score.

“The courses are designed to teach the students the skills and knowledge to be successful posteducation in the real world,” Spratt explains. “I, personally, emphasize to the students to adopt a lifelong learning mind-set to continue to grow in their careers.”

Junior Achievement has individual program materials specific to each grade level that meet the curriculum outcomes and state standards for its economic and financial literacy units. Through JA, corporate and community volunteers will work with 6,000 K through 12 students in Lawrence this year providing relevant, hands-on experiences that give students knowledge and skills in financial literacy, work readiness and entrepreneurship.

Spratt says he hopes to imbue a basic understanding of making smart academic and economic choices. “Knowledge is powerful in our economic system. Education both in and out of the classroom has shown to be the driving force, along with dedication and hard work, to success in our society,” Spratt explains.

“Uninformed decisions about finances can bury young people if they make poor choices about spending and debt,” he cautions. “It is a leading cause of divorce, which causes other family issues that can lead to financial stress and failure. Intelligent choices about one’s finances many times lead to more options in life.”

In addition to the current financial education offerings in the schools, Anthony Lewis, superintendent, is working on a partnership with the School of Economics, a nonprofit organization founded in 1994 in Blue Springs, Missouri, with more than 12,000 students that uses reality-based education to teach children how to prepare for their financial futures. Through UMB Bank grants, Lawrence schools will receive discounted student fees at the upcoming Kansas City location, with a 60 percent or more free/reduced lunch rate. Free pilot programs in May will be held to evaluate alignment with the district’s grade-level objectives.

“We want to empower our students with how to think through important decision-making regarding finances and financial planning,” Bessolo says. “We know students have more options today than ever before, and we want them to feel prepared to manage finances and, most importantly, feel confident about the decisions they are making.”

Troop leader Becky Maletsky with Girl Scouts Zoe D, Sammy J, Kellar M, and Gabel P selling Girl Scout cookies on a frigid day in front of Global Café.

IT TAKES A VILLAGE

In addition to public schools, other organizations throughout the community offer unique opportunities for kids to learn about finances.

The Girl Scouts, a K through 12 organization, runs a $2-million business over three months every year. Participants have an opportunity to run their own businesses through the 100-plus-year-old Cookie Program. “Financial literacy is critical for today’s youth, especially girls,” says Gina Garvin, Girl Scouts of Northeast Kansas and Northwest Missouri chief brand and marketing officer. “We are unique because girls have an opportunity to literally run a business at the age of 5, 10 or 15.”

Each year, she explains, they build upon their financial savvy while not just learning through a textbook but literally getting hands on. “This program is research-based and helps girls hone five business skills that last a lifetime: decision-making, goal-setting, people skills, money management and business ethics. Female entrepreneurs and business leaders will often state they got their business savvy through their experience in the Cookie Program,” Garvin says.

And on the flip side, Boy Scouts also have the opportunity to run their own businesses through their annual popcorn sales, the largest single program the group does involving personal finance.

“It’s more than just a fund-raiser,” explains Paul Taylor, Heart of America Council, Boy Scouts of America district executive, Pelathe Scout District. “Scouts go door to door to sell popcorn; they also set up ‘show ‘n’ sells’ at locations in our community. And now, they have the ability to set up online sales.”

Through this program, Scouts are responsible for achieving their own personal goal, which ties in with their unit’s goal, to learn and improve their public-speaking skills, to record and turn in orders, and to deliver the product back to their customers. “It’s a lot of responsibility,” Taylor says. “This last year, Pelathe District, which encompasses Douglas County, Lawrence, Baldwin City and Eudora, brought in over $156,000 in popcorn sales.”

Both the Girl Scouts and the Boy Scouts offer financial-literacy programs where Scouts earn badges by doing activities related to financial planning.

RURAL ROOTS

The Douglas County 4-H program also offers an education in financial literacy. Around since 1902, 4-H works with kids aged 5 through 18 providing learning opportunities in a variety of different areas, including foods and nutrition, visual arts, livestock, STEM (science, technology, engineering and math) and financial literacy, among others.

“Teaching responsibility is one of the many goals we have in our program,” says Kaitlyn Peine, Kansas State Research and Extension, Douglas County, 4-H youth development agent. “We start teaching kids around middle school about financials. We encourage saving and planning for college through our teen programs.”

Peine believes the best way to teach kids about finances is through hands-on learning. “We encourage record-keeping and for the kids to work with the adult volunteers to balance the checkbook and create monthly treasurer reports.”

She explains the group focuses a lot on budgets. “Typically, a group of committee members, including youth and adults, will work together to form a budget. Income and expenses are reviewed on a regular basis,” she adds.

Because 4-H clubs (Douglas County has 10) are self-funded, special programs, community-service projects or project-learning experiences require funds to be raised by its members. “We encourage group fund-raisers so the kids gain teamwork, communication and leadership skills,” Peine says.

Ernesto Hodison, vice president at Capital Federal Savings Bank speaks with students and faculty at Bishop Seabury Academy (Photo courtesy of Bishop Seabury Academy)

HEALTHY HABITS

Another community-based organization that helps children acquire financial skills is the Bert Nash Community Health Center, a nonprofit mental-health organization founded in 1950 and dedicated to improving the health of Douglas County residents and children through comprehensive behavioral-health services responsive to evolving needs and changing environments.

Mac Crawford, Bert Nash child and family outpatient program manager, says research done by the organization shows kids as young as 5 years old can begin to grasp the concepts of savings and delayed gratification. “This natural, early development paired with developmentally appropriate ‘deep dives’ into credit, college saving, etc., throughout transition into adulthood is ideal.” Generally, he explains, between the ages of 5 and 18, the key is a step-up system introducing key concepts paired with natural environmental examples on which to build.

Bert Nash provides exposure to financial literacy within the population it serves, many of those who face socioeconomic barriers that can work to otherwise impede asset development. “The psychosocial impact that financial uncertainty can have on mental health is also an intersection that many of the individuals we work with would benefit from,” Crawford says.

He believes the best approach to teaching financial literacy is through direct practice, accessing community resources, having direct contact with community financial providers and hands-on savings activities, all which Bert Nash provides. Crawford hopes his clients learn “the salience between the idea that efforts put into saving for one’s future can be small and slow, and still have a tremendous impact with time.”

The organization is currently working to incorporate a financial-literacy component into a group format that will reach a broad population, as well as planning to expand on this as it addresses the growing need for independent living skills among transition-aged youth.

“This program is still in development, but an active role in accessing financial organizations and partners in the community would be a large part of this,” Crawford explains. “Activities around savings and, ideally, a match for certain savings goals would also be a portion. Education around savings, banks, etc., would be the core component.”

Mike Everett and Chris Bay of Life, Success and Le-gacy speak with potential clients at the Pine Landscape Center Outdoor Connection Expo.

A DIFFERENT APPROACH

Some may decide to explore alternate avenues of financial education for their families and kids. The Infinite Banking Concept is one of those.

The concept addresses many of the financial needs young people are going to face during the course of their lives, explains Chris Bay, Infinite Banking coach with Life Success & Legacy, and former teacher and principal in Lawrence Public Schools. “It is simple, flexible and guaranteed,” he says. “Most people admit that finances are in the top three of life’s stressors. How does that young person’s quality of life change when they have simplified their financial life, established a plan for addressing their debt, current and future finance needs, investments, retirement and financial legacy? It becomes a very peaceful way to live.”

The Infinite Banking Concept provides information in a simplistic format so young people can question what many adults are doing with their money. It encourages young people to “rethink their thinking,” Bay says.

He encourages his clients to start an Infinite Banking Concept (IBC) strategy for their children as soon as possible. That involves meeting with a team member who helps them increase their own level of clarity and purpose they have for their life. Then, the Life, Success & Legacy team designs a personalized IBC strategy to support that vision. If the children demonstrate maturity and a willingness to learn and apply the concept, the parent can sign over ownership to the child. If not, the parent can maintain ownership of the strategy but still utilize it.

“As an alternative to allowance, I would encourage parents to create a ‘menu’ of learning opportunities for their kids,” Bay explains. “This menu of learning opportunities would include those topics that the parents believe are valuable. The parent then lists a dollar amount next to the learning opportunity that the parent is willing to pay if the child participates.”

With his kids, Bay requires they demonstrate their learning in some way, such as watching a video on a topic he wants them to learn. Then, the child demonstrates his or her learning in some format like a paper or demonstration. Finally, they are paid the agreed-upon amount. “When the child wants a toy or to go to the movies with their friends, we don’t have to give them money because we have provided them opportunities to earn money,” he says. “And we are exposing our kids to information we believe is valuable for their development. Now, the parent is getting a little ‘return’ on their money.”

STRIVING TO SUCCEED

However parents and kids choose to pursue their education in finances, whether through school programs, community groups or other offerings, it’s imperative to a successful future that children learn early and practice often.

JA’s Spratt believes kids ultimately need a basic understanding of how businesses operate along with an understanding of personal income, taxes, budgeting and savings on a personal basis. He encourages young people to choose a career that matches their passions along with their values, interests and skills.

“As our society continues to be increasingly debt dependent, we need to teach our youth about the importance of a personal budget, making informed purchase decisions and long-term financial planning,” Boy Scouts’ Taylor adds.

Bert Nash’s Crawford agrees. He says education about financial stability is an “extremely vital role of developing into a self-sufficient and successful adult.”